Abstract: By the end of this week, blast furnace operating rate of domestic steel mills has dropped slightly for three consecutive weeks, the most obvious decline in North China and South Africa, for iron ore and coal coke market demand has an impact. At the same time, the impact of IF furnace renovation still exist, some large and medium steel mills have been planning to take the opportunity to make up some scrap resources at low prices to replace part of the molten iron, which may pull down the price of coal coke prices. Is expected next week, the domestic raw materials market will be weak to adjust the main shock.

Current view: high pressure to increase raw materials weak shock

Time: 2016-12-12-2016-12-16

Market review - billet ore continued to rise, coal stabilized scrap shock;

● Cost analysis - steel costs rose fairly, iron and steel enterprises generally profitable;

● Stock analysis - Overlay of environmental factors for replenishment and increase of overall stock of steel mills;

● comprehensive view - significantly increased the high pressure, short-term adjustment of raw materials shocks.

First, this week the domestic raw materials market review

Compared with the futures market, this week the domestic raw materials market overall performance placid. In addition to billet by environmental factors to help, the other varieties are mainly small fluctuations,

Table 1: Price changes of major domestic raw materials

This week the main raw material market conditions are as follows:

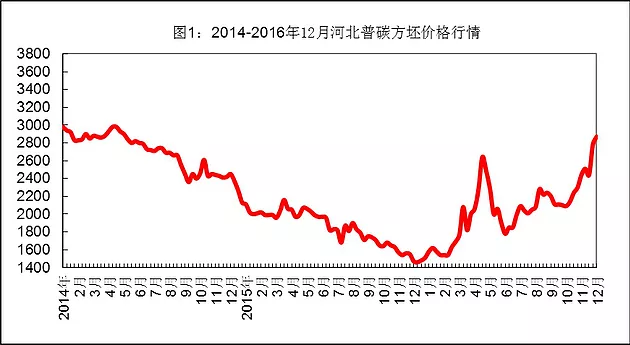

Billet:

Affected by environmental rectification, domestic billet prices continued to rise this week. As of Thursday, the ex-factory price of Tangshan CSPC billet rose to RMB 2,870 / t and the ex-works price of 20MnSi billet was RMB 3,010 / t, up RMB 90 / t from last weekend, again touching the high of this year; Jiangsu 20MnSi Billet price of 3110 yuan / ton, compared with last weekend rose 60 yuan / ton. From the demand situation, the current operating rate of Tangshan strip enterprises remained at 79%; profiles operating rate decreased by 10% to 45%, building materials operating rate fell 5% to 30%, demand has slowed from the previous month. After the continuous rise in prices, the second half of the billet market transactions in general, the lower reaches of the high-priced resources to wait and see, futures adjustment is also to some extent affected the market mentality.Domestic billet prices are expected to be slightly adjusted next week.

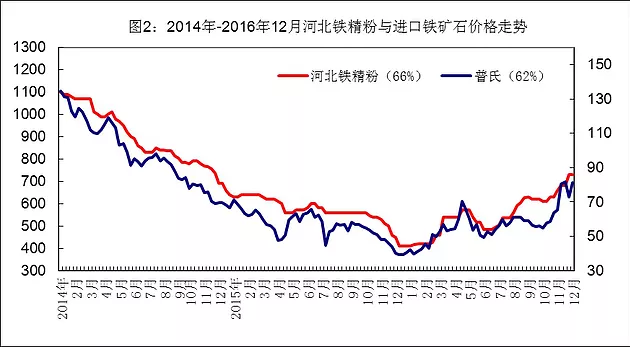

Iron ore:

Domestic iron ore prices continue to rise this week. In the futures market, driven up, Platts prices to return to 80 US dollars / ton, once a record high this year, 82.3 US dollars / ton (CIF), up 5 US dollars / ton last Friday. But since then the market turnover was slowed down, some spot traders also take the initiative to cut prices shipping, import ore prices fell slightly again. This week the domestic iron ore market is relatively stable, Hebei and Anhui region iron powder prices remain at 705-730 yuan / ton, inquiry has increased. According to statistics, China's iron ore imports in November reached 91.98 million tons, an increase of 11.99% this week, China's imports of ore to the volume has increased significantly, the port stocks continue to remain high. After nearly a month of violent shocks, some traders fear high emotions increased, the intention to reduce the inventory before the end of the year, the ship has increased the enthusiasm, while the steel side more early stocking, coupled with the recent pressure to rectify the environment, wait and see mood Thicker. Is expected next week, domestic prices of imported ore will be slightly down.

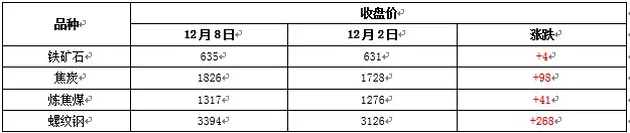

Fourth, this week, financial derivatives market changes (the main contract)

This week, steel and iron ore futures rose and then fell, continue to fluctuate, coal fluctuation range was significantly narrowed, the second half of the week were significantly lighten up, positions down. The current high part of the continuation of the initiative to significantly reduce the concentration of long, high pressure area of funds selling pressure is expected to adjust next week is still the main shock.

Table 5: Changes in major futures and futures prices for major steel and raw materials this week

Pre: Kraal net uneven how to install? What drawback is that?

Next:Dayz wire fencing